A veteran police detective addresses an elderly woman on the front steps of her Collingwood home. He’s holding a cashed cheque for $140,000, money he already knew she had been scammed out of.

“I’m Detective Sergeant Jason Lloyd with the Ontario Provincial Police in Collingwood,” he says, handing her his business card. “Do you recognize this cheque?”

She explains it was her cheque and that she wrote it to pay for renovations to her kitchen and bathroom.

“They even painted the walls,” she tells the detective. “I’m not too happy with the paint, but they painted my walls.”

Lloyd asks if he can come in to get a closer look, but the woman denies his request.

“It’s none of your business,” she says. “I’m happy with the work.”

For the rest of the day, Lloyd and other police officers on his investigative team from the Collingwood OPP crime division worked to convince the woman and her son that they were the victims of fraud. A specific scheme spanning months, maybe years, that would eventually end with them losing their home.

“I showed the son there was a mortgage on the house,” says Lloyd in an interview with CollingwoodToday. “He argued there was no mortgage … that it was a fake.”

But it wasn’t fake. It was signed by his mom, even though she didn’t know she was signing it. And it was overdue, even though they received no notice.

***

The mother and son are two of dozens of Collingwood residents and millions of Canadians whose money and/or property has been stolen by scammers.

An increase of successful and attempted scams and frauds has Collingwood police officers speaking out to warn residents to be aware of tactics used by scammers.

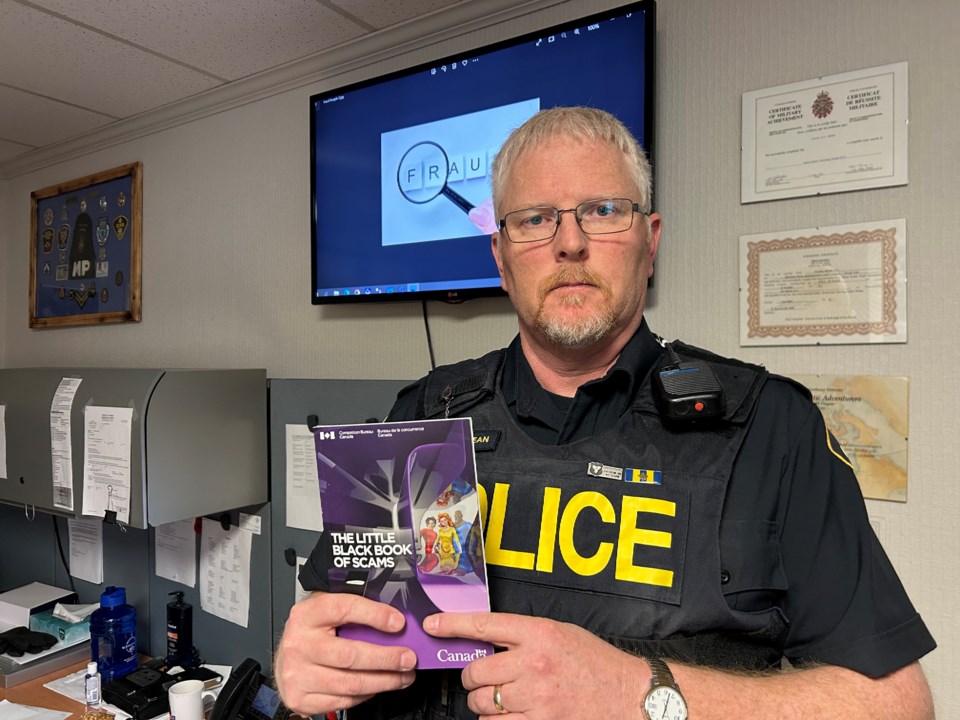

Const. Trevor McKean, a police officer for 30 years and currently the community safety officer, says there are several scams becoming more and more prolific in Collingwood, and that no community has escaped their long and winding tentacles.

The Canadian Anti-Fraud Centre reported about $379 million lost in scams and frauds by Canadians in 2021, a 130 per cent increase over the estimated loss in 2020, and the highest annual loss in Canadian history.

In Ontario alone, there were 19,084 reports of fraud in 2021 amounting to about $142 million lost, according to the anti-fraud centre’s annual report.

The scams range in type and target.

Various versions of romance scams bilked Canadians out of $64.6 million in 2021, all dollars sent in good faith by people who believed they were in long-distance and long-term relationships. People who were tricked into falling in love.

The Canadian anti-fraud centre reported $12.3 million and another $1 million in losses to merchandise and counterfeit merchandise fraud for 2021, and nearly $18 million lost to extortion. People who are victims of extortion are often threatened with criminal charges, jail sentences, fines, death, and direct harm to family members by fraudsters.

In phishing scams, simply clicking a link in an email can result in a person’s identity being stolen and/or business email systems being compromised and important data being held hostage. In 2021, these types of scams were used to steal nearly $54 million.

There are others, too. The “grandparent scam” typically preys on elderly people as someone calls and impersonates a grandchild. The story usually involves trouble with the police or a medical emergency, and the grandchild asks for money for “bail” or something else. Part of the scam will involve another person impersonating a police officer or other authority figure who will organize a money transfer. Often, a scammer will attend the grandparent’s home to pick up the money. Canadian grandparents have handed over hundreds of millions of dollars in this scam. There were more than a dozen reports of this scam in Collingwood over just a few days.

The Criminal Code of Canada doesn’t require monetary deposits for bail, explains Const. McKean.

Canada has a surety system, which must be done in the court system, and uses a “promise to pay” if an accused person does not attend their court dates. A surety is a person who must supervise the accused person while they are out of custody and awaiting court appearances.

“Typically, bail is going to be a surety, and that person has to attend the court, at least virtually,” says McKean. “The Canadian bail system is very different than the US one … it’s very important to me that people know that.”

***

Detective Sergeant Lloyd remembers when he first realized a local call about a suspicious renovation might be one string on a wicked web of lies, misdirects, and fraud.

“There was a real motivation [in the crime unit] to really sink our teeth into this,” says Lloyd. “This is a lot of work, but definitely worth it for sure.”

The mortgage fraud, which ensnared the Collingwood mother and son and others, was first discovered in Collingwood and has been identified as a mult-faceted scam involving door-to-door sales, a secret remortgaging scheme done without the homeowner’s knowledge, and shoddy home renovations. Its victims are all over.

Lloyd, who runs the Collingwood OPP crime division, has been on the mortgage fraud case since the first renovation investigation and has discovered more local victims. Unknowingly, people have taken out mortgages on their homes, only to have the homes taken away when payments are not made. The owner of the home is often never aware payments are due.

According to Lloyd, the victims are most often elderly people who believe they’re signing a service contract to get out of payments for things like air conditioner units or air purifiers.

And the scam started years ago when those air conditioners were first installed.

A door-to-door salesperson will later convince a homeowner they are overpaying for those services, and present some way they can get money back, for example through a class-action lawsuit.

The homeowner will later speak with a lawyer, often virtually, and will be prompted by the salesperson (who is off-camera) to answer specific questions a certain way.

“They believe they’re signing a legal contract to get out of payments, when in fact they’re actually signing mortgage documents,” says Lloyd. “It is a legal mortgage, but it’s been done fraudulently.”

Later, a cheque will arrive, disguised as the winnings of the fake lawsuit, but the money will be from the refinanced mortgage, which the homeowner still isn’t aware of.

“It’s their own money,” says Lloyd. “Then what they say is that the courts have ruled … you’ve won this sum of money … but the courts have ruled that part of this reward money that you’ve been given, needs to be invested into your house.”

They’ll be told the condition of their winning the lawsuit is to use some of the money for a home renovation. The home renovation contractors will over-charge, but because it’s less than the full amount they received from the scam, often homeowners will agree to it.

They are given options for what they can or can’t do in the interest of a “sustainable home,” and they get a quote, which is lower than the amount they received.

“And they’re thinking, ‘wow, I got the work done, I got all this cash in the bank,’” says Lloyd. “But it’s their cash!”

Months, or years later, the mortgage defaults because of non-payment and the lenders take the home. Sometimes it can show up after a person dies and the home is in the estate but has a mortgage with a high interest and late fees attached to it.

“The contract that they sign, it’s a bunch of legal jargon, but if you read the fine print … the payments are due per annum and you don’t get any notice if you’ve defaulted on a payment,” says Lloyd. The interest rates are usually upwards of 25 per cent. “It’s scary. And we have victims like this all across Ontario.”

Typically, the scammers tend to target people with home phone lines, which are usually elderly people, says Lloyd.

“These are wonderful people that want to do right by their kids and their families,” says Lloyd. “It tugs at your heart because these are real victims.”

Most scams go unreported, whether because people are embarrassed or, as is the case of the mortgage scam, they don’t know they’re victims.

The local victims are elderly people, some of whom had modest lifestyles and were living in family homes they inherited. Often, they live alone. Sometimes they will call police or otherwise report what they see as poor-quality renovations.

“At first blush … it looks like a civil matter. You had a contractor and they did some of the work and you don’t like it … that’s a civil matter,” says Lloyd. “But if you really dig … the entire thing forms an elaborate fraud. There’s so many layers. And that’s what’s happening with all of our frauds. There are so many layers and so many people that are working it.”

The detective says there are many ongoing investigations into occurrences of the mortgage scam, with several other police agencies involved.

“The more victims we came across, we had a better understanding of the way the scam worked,” says Lloyd. “I can tell you … there’s more than one group that’s involved … and they do it because it works. It’s an organized crime group.”

Lloyd says he knows there are still victims out there that haven’t been found.

“I’m confident that there’s going to be people that are one day going to come forward to inherit their family home and realize there’s a massive lien against it because of what these people are doing,” says Lloyd.

***

There are many scams running. Some have been around for a long time and use older distribution methods such as snail mail, while others use the latest in ransomware and computer software to steal data.

McKean recalls a local case where a woman received a letter informing her she had won a Publisher’s Clearing House lottery and she could have her winnings after she paid the taxes to release the money.

“She pulled $25 grand out of a coffee container in her home, put it in an envelope and mailed it,” says McKean.

She did, however, opt for a tracking number, and ended up reporting it to police the next day. Her money was rerouted to the police station and she got it back.

“You don’t pay taxes on lottery winnings in Canada,” says McKean.

Canadian law also requires you purchase a ticket in order to win a lottery prize.

As if being scammed once wasn’t bad enough, there’s also a common “recovery pitch” scam, which involves someone contacting a person who was victimized in the past and impersonating an investigator, law enforcement, or a lawyer, promising to get your money back. Often, victims are promised some or all of their lost funds, provided they pay legal fees and/or taxes.

The end result is more money lost by the victim.

Victims can range in age, education, background, and socioeconomic status.

“The people who are being deceived … are very smart people, well-educated people who fall victim to these things,” says McKean. “Sometimes we let our guard down.”

It may be unrealistic for everyone to know enough about Canadian law that they can see through a scammer’s tactics, but there are basic things people can do to avoid becoming victims.

With more than 50 years in policing between them, McKean and Lloyd are hoping that by sharing information and tips, people can prevent fraud, and avoid becoming a victim of a scam.

“I’ve been watching frauds evolve,” says Lloyd, who has been in policing for 26 years, including 16 in the crime unit. “Most of these frauds now, they are so elaborate. They involve groups of people because they’re making large amounts of money in these scams.”

Both Lloyd and McKean say it’s critical not to let any salespeople into your home, and never to show them any bills, accounts, or otherwise personal information about you or your home expenses.

The OPP recommend not opening your door to an unknown person, instead talk through it. Do not invite a person in who approaches you in your yard, and if a salesperson tries to rush you to buy something, continue refusing it. Ask them to leave, and if they don’t, call police.

Phone call scams are usually unsolicited, they may claim you’ve won something, or use threats about your online shopping accounts, claim you owe taxes or are getting a tax return, or threaten you with arrest. You don't have to answer their questions or agree to send money.

“If you’re not sure, hang up,” says McKean.

The OPP and Canadian Anti-Fraud Centre remind everyone the Canada Revenue Agency would never request payment by pre-paid credit card or gift card, and would never threaten with court charges, jail, or deportation.

If a person is calling and claiming to be tech support, but the call was not requested by you, do not agree to the support and do not give access to your computer.

If a caller claims to be a bank inspector asking you to help catch a criminal, do not withdraw money from your account.

Never send money for bail or other court or police-related instances, no matter who you think is asking for it. Instead, call the police or Canadian Anti-Fraud Centre.

Don’t sign any contracts without an expert opinion. It’s also wise, according to Lloyd, to regularly check your mortgage and credit using services such as Equifax or TransUnion. Check your bank and credit card statements regularly, and never share your PINs with anyone, not even the police or bank should request a PIN.

Finally, report suspected fraud or scams to police or the Canadian Anti-Fraud Centre.

McKean takes his tips on the road with a specially crafted presentation on fraud prevention he delivers to community groups in Collingwood and The Blue Mountains. Const. McKean can be reached at the Collingwood OPP detachment by calling 705-445-4321. There are also printed resources on fraud prevention available at the local OPP detachment.

You can contact the Canadian Anti-Fraud Centre at 1-888-495-8501 or visit the website here.