A draft proposal from consultants suggests a 100 per cent increase in the town’s non-residential development charges.

The proposal also suggests a 25 per cent increase in the town’s residential development charges.

Jackie Hall from Hemson Consulting Limited delivered a report on the 2019 Development Charges Background Study to the Strategic Initiatives Standing Committee on May 28. Hemson is preparing the study for council to update the town’s development charges before the current bylaw expires in September. The current development charge rates were calculated in 2014.

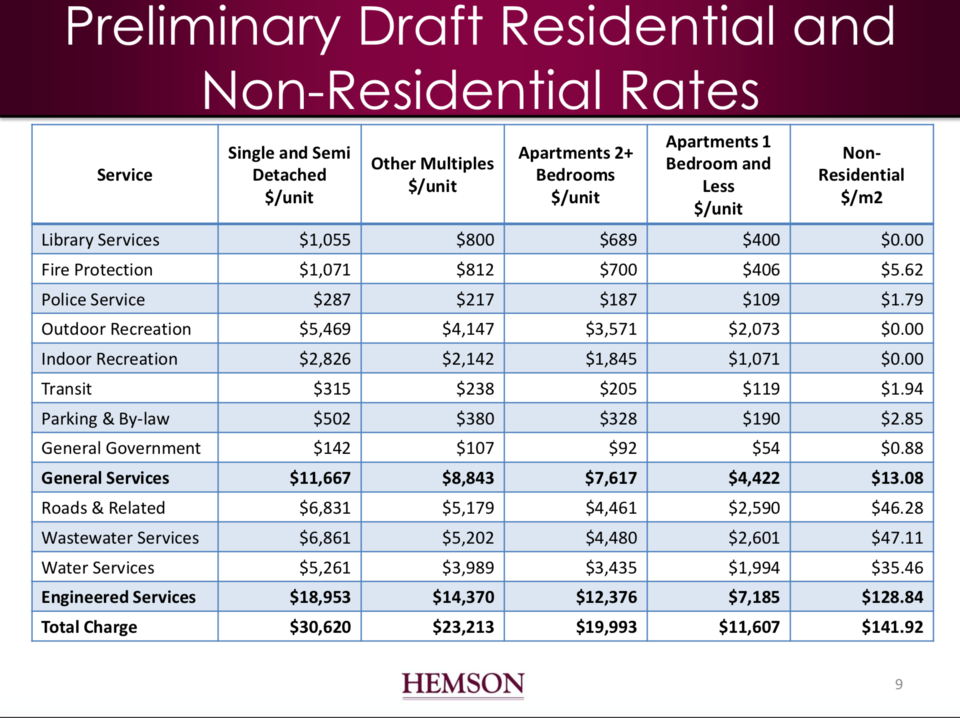

Hall’s presentation included preliminary draft rates that are calculated based on the town’s growth related services and capital projects, and according to provincial legislation.

The draft rates propose a development charges of $30,620 for a single or semi-detached residential unit, $23,213 for other multiple units, $19,993 for apartments with two or more bedrooms, and $11,607 for apartments with one or fewer bedrooms.

The current rate for a single or semi-detached dwelling unit in Collingwood is $24,572, which is $6,048 less than the proposed draft rate.

The suggested rate for non-residential units is $141.92 per square metre.

The non-residential rate is currently $68.78 per square metre and is proposed to increase by $73.47.

Hall said the town council at the time "effectively approved a discount in the non-residential rate."

She said any discounts applied to development charges must be made up through other forms of revenue including property taxes.

The background study also includes a list of major development-related projects forecast over the next 10-12 years.

Hall’s presentation included a second library building on that general services capital projects list - at a cost of $4.9 million.

Other items included a new east-end fire station ($4.6 million), a 100-space parking garage ($4.4 million), a 100-space parking lot ($3.4 million), a baseball facility ($5 million), waterfront master plan projects ($36.3 million), trail development ($1.6 million), and a multi-purpose recreation facility ($27.9 million).

The major capital projects for the town’s engineered services include $76 million for road upgrades, intersection improvements, and sidewalks, $35.2 million for watermain extensions and upsizing, $9.1 million for the expansion of a water treatment plan, $6 million for sewer infrastructure, and $90 million for a new water pollution control plant.

Collingwood’s total population (including full and part time residents) is expected to increase by 14,490 people by the year 2031, according to the Hemson presentation.

When it comes to general services, Hemson is recommending the highest dollar value increases for residential charges in the areas of library services ($460 increase per unit for single or semi-detached homes), fire protection ($396), recreation (outdoor $1,733 and indoor $2,100), and parking and bylaw ($362).

According to Hall, development charge rates have increased in many municipalities in Ontario over the last two years due to a combination of factors including increased construction costs, higher land values, better asset management planning by municipalities, and improved capital planning by municipalities.

Hall told the Strategic Initiatives Standing Committee the background study would be released on Monday, June 3, with a public meeting to follow. Hall anticipated the new rates bylaw passing by August 26 at the latest.

According to Hall, the province’s Bill 108, announced May 2, 2019, has thrown a wrench into any plans made around a municipality’s development charges as the bill includes changes to 15 pieces of legislation including the Development Charges Act and the Planning Act.

Hall said it wasn’t clear exactly what those changes will be and how they will be executed if the bill is passed, therefore she couldn’t give a clear explanation of how it would impact Collingwood’s new rates, if at all.

Some of the changes Hall said were possible in the new legislation include a change to the timing of development charge rates by a developer. There’s a possibility the development charge rates could be “frozen” early in the process (site plan application) and therefore impact how much a town can collect in development charges later on - and it could be after rates have increased through the development charges background study process.

The other change being suggested is moving some services out of the development charges act and into a new Community Benefits Bylaw umbrella, which would change how development charges can be calculated.

Hall said Hemson Consultants planned to submit comments to the province on Bill 108 based on their experience working with municipalities and other clients on a number of the 15 pieces of legislation slated for change through the bill.

Dennis Sloan, a Collingwood staffer in the treasury department, followed Hall’s presentation to let the standing committee know the consultants worked with town staff to gather the information necessary to calculate the proposed draft rates.

He said the town is eligible to collect $9 million for growth infrastructure projects.

“If growth doesn’t pay for growth, then the existing ratepayers will pay for it,” said Sloan.

Council will hear more from staff on the development charges background study at its next meeting, June 10.