The Towns of Thornbury development has fallen into receivership and will soon be sold to the highest bidder.

The prominent development adjacent to the Foodland grocery store has been under construction for several years and was recently placed into receivership by Ontario Superior Court Justice Peter J. Cavanagh. The project’s lenders, Foremost Mortgage Holding Company and Foremost Financial Corporation, asked the court to place the property in receivership after the property’s owner defaulted on mortgage payments.

Foremost says it is owed $8.8 million on the property, with costs and interest continuing to accrue.

In late December, Justice Cavanagh appointed KSV Restructuring Inc. as interim receiver.

A representative from Foremost told CollingwoodToday via email that the company’s plan is to sell the property to the highest bidder sometime in February if the loan owed to the company was not paid by the end of January.

“Foremost provided construction financing for the project and is a secured creditor on the property. Unfortunately, the borrower defaulted on his loan, at which point we brought an application to have KSV Restructuring Inc. appointed as the interim receiver for the subject property,” said Max Miller, Foremost’s associate vice-president of mortgage lending. “KSV will conduct a court-approved sales process for the property commencing in early February if our loan is not satisfied by Jan. 31.”

The Towns of Thornbury property is owned by a numbered company: 2521311 Ontario Inc., which is owned by Nick Sampogna, who is the president of the Janik Group. A link on the Janik Group’s website to the Towns of Thornbury project is no longer active.

Court documents filed in the case reveal multiple issues with the ongoing construction for the 23-unit subdivision in the heart of Thornbury.

They include:

- Significant water penetration, foundation, mould and fire separation issues.

- The registration of several construction liens on title to the property.

- Stop work orders, orders to comply and orders to uncover made by the Town of The Blue Mountains (where the property is located) in connection with the Project.

KSV reported to the court that the project requires several million dollars more than its initial budget to complete. KSV also told the court that the developer had pre-sold 21 units and collected $1.64 million in deposits from purchasers. According to the receiver’s report, all but $53,000 of those deposits were spent on construction costs.

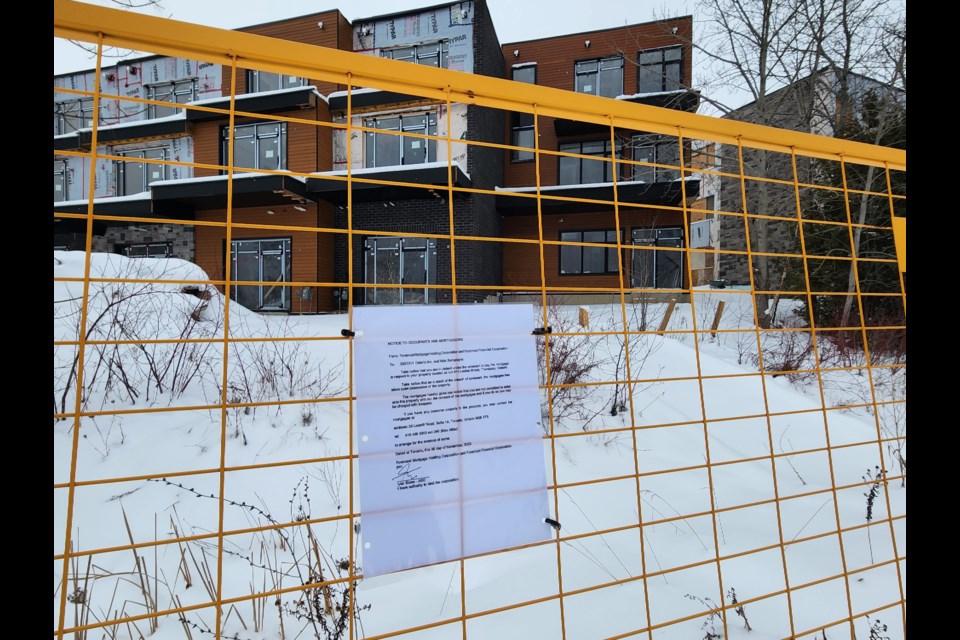

A notice posted on the fence surrounding the property says the lenders have taken control of the property. Court documents state that the Foremost was anxious to take control of the property to protect the buildings from the looming winter.

“The project site remains exposed to the elements. As the upcoming winter approaches, the project’s value, and the prospect of creditor recovery, is steadily deteriorating. Winterization measures are therefore a critical priority to protect the remaining value in the project,” Foremost stated in a court document.

With significant portions of the buildings on the development unfinished and exposed, Miller said there is construction activity on the site as the receivers do work to protect the buildings from the winter weather.

“Since the appointment of the interim receiver, there has been some minor construction on-site, mainly related to weather-proofing the units,” said Miller. “The current activity on site is to protect the buildings from the elements.”

Emails from CollingwoodToday to Sampogna requesting a comment on the situation were not returned.

In mid-December before Justice Cavanagh’s decision, the property owner’s lawyer – R. Brendan Bissell – responded to Foremost’s petition for a receiver to be appointed and said the lender had acted prematurely.

“The respondent should be given proper time to respond to evidence that is incorrect or selective. The respondent also fairly needs time to seek alternate lenders now that the applicant has decided (two months after maturity of its mortgage) that it will not deal with the respondent further,” the court filing stated.

The response also stated that the mortgage company was aware of many of the issues with the project, that two of the three liens on the property had been settled and that any stop work orders from the municipality had been addressed.

The full response and all related court documents can be found online here.

Tim Hendry, manager communications and economic development for The Blue Mountains, said the town has no formal comment on the current status of the development. Hendry said the town continues to monitor the issue.

“The town is aware of the situation and has been in contact with the mortgage holder. The property is being actively monitored by the town to ensure that it does not represent a safety risk to the public,” he said in an email.

CollingwoodToday spoke to one local resident who had purchased a home in the Thornbury Towns development, who asked that her full name not be used in this story.

After purchasing a unit in 2020, she described a stressful situation and multiple delays waiting for her home to be finished and having to move several times when it didn’t happen.

“The first completion date promised was August 2021. We moved here from Toronto in June 2021. We moved to Collingwood waiting for the build to be completed. I was driving almost 100 km to take my kids to school and back daily in Thornbury,” she said.

Delays forced her and her family to move out of their first rental home in Collingwood after six months and find another place to live while the construction continued.

“A year and a half of expectations for the landlord and myself, news of the house’s completion every six months,” she said. “We experienced seven more delays. The house was stalled. No activity on the 21 units.”

She said the final straw for her was a request for the builder on a Monday for another $100,000 for the project to be paid that Friday. She pulled out of the project in May 2023 and said the deadline for her deposit to be returned was the end of January 2024. She is now renting a home in Thornbury.

“The stress was so much, I took time off. And pulled out of the project,” she said.